Understanding Wealth Protection: Smart Strategies for Volatile Markets

- Details

In today's unpredictable financial landscape, protecting your wealth has become more crucial than ever. With recent market volatility triggered by trade tensions, geopolitical conflicts, and economic uncertainty, investors worldwide are seeking strategies to safeguard their portfolios during turbulent times. Whether you're a retail investor, high-net-worth individual, or financial professional, understanding wealth protection is essential for long-term financial success.

What is Market Volatility and Why Does It Matter?

Market volatility represents the degree of variation in trading prices over time. The spring of 2025 witnessed substantial market turbulence, with U.S. financial markets experiencing sharp volatility due to aggressive tariff policies and geopolitical tensions. More recently, markets have faced additional pressure from Middle East tensions, with the Sensex and Nifty experiencing significant declines.

Research shows that 60% of investors are concerned about recent stock market volatility, with the majority expecting this turbulence to persist through 2025. This fear-driven environment often leads to poor investment decisions, as loss aversion drives emotional decision-making that can damage long-term returns.

Why Wealth Protection is Crucial

Market downturns trigger powerful emotional responses. During the tariff-induced selloff in early 2025, those who panic sold at market lows missed the subsequent 15% recovery, significantly damaging their long-term returns. Market psychology often overrides fundamental analysis, causing investors to make decisions based on emotions rather than sound financial principles.

Wealth protection isn't about avoiding growth entirely; it's about finding the right balance between capital preservation and growth potential. A well-structured strategy provides financial immunity - the strength to withstand economic shocks without compromising your family's well-being.

Smart Wealth Protection Strategies

1. Portfolio Diversification: The Foundation

Diversification remains the cornerstone of wealth protection. By spreading investments across different asset classes, sectors, and geographic regions, you reduce overall portfolio risk while maintaining growth potential.

Effective diversification includes:

- Equity diversification: Large-cap, mid-cap, and small-cap stocks

- Sector diversification: Different industries

- Geographic diversification: International markets

- Asset class diversification: Stocks, bonds, real estate, and alternatives

2. Strategic Asset Allocation

Asset allocation involves determining the right investment mix based on your risk tolerance, time horizon, and financial goals. A typical balanced approach includes 60-70% in growth assets (equity) and 30-40% in defensive assets (bonds, cash) for long-term investors.

3. Emergency Funds: Your Safety Net

Emergency funds should cover 6-12 months of expenses in highly liquid assets. This buffer prevents you from being forced to sell investments at unfavorable times during unexpected events like job loss or medical emergencies.

4. Insurance and Risk Coverage

Insurance acts as a financial safeguard against unforeseen events. Essential coverage includes health insurance, term life insurance, disability insurance, and property insurance. A term insurance policy of ₹1 crore can cost as little as ₹20 per day.

5. Low Volatility and Dividend Stocks

Low-volatility dividend stocks provide stability and passive income during uncertain times. These stocks typically have beta values below 1.0, meaning they're less volatile than the broader market.

6. Systematic Investment Plans (SIPs)

SIPs help build wealth through disciplined investing by benefiting from rupee-cost averaging, reducing the impact of market volatility by spreading purchases over time.

7. Hedging with Gold and Government Securities

Gold serves as a hedge against inflation and currency devaluation. Government Securities (G-Secs) offer negligible credit risk and stable returns, including Treasury Bills, Dated Government Securities, and Sovereign Gold Bonds.

8. Professional Advice and Rebalancing

Regular portfolio rebalancing ensures investments remain aligned with your target allocation, allowing you to "buy low and sell high" by trimming overperforming assets and adding to underperforming ones.

Common Mistakes to Avoid

1. Panic Selling

Panic selling is the most damaging mistake during market downturns. A J.P. Morgan study found that missing just the 10 best days in the market over 20 years would reduce returns by approximately 50%.

2. Market Timing

Market timing requires being right twice - on both exit and entry points. Even professional investors struggle to accurately predict market movements.

3. Over-Concentration and Ignoring Inflation

Concentrating too heavily in high-risk assets exposes portfolios to significant losses. Additionally, inflation erodes purchasing power, making inflation-hedging assets crucial for long-term wealth preservation.

Real-World Case Study: The Power of Diversification

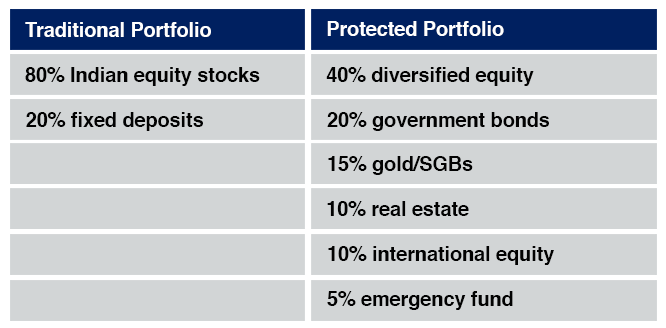

Consider an investor with ₹10 lakh in two different portfolio structures:

During a 30% market crash:

- Traditional portfolio lost 24% of its value (₹2.4 lakh loss)

- Protected portfolio lost only 14.5% of its value (₹1.45 lakh loss)

- Difference: 9.5 percentage points less loss, saving approximately ₹95,000

Conclusion: Building Financial Resilience

Wealth protection is about smart financial discipline that allows you to weather market storms while staying on track toward your long-term goals. The strategies outlined work together to create a robust financial foundation.

Remember that successful wealth protection requires consistency and patience. Market volatility is inevitable, but your response determines your long-term financial success.

Take Action Today

- Evaluate your current portfolio for proper diversification

- Establish or review your emergency fund

- Consider your insurance coverage needs

- Explore systematic investment plans

- Consult with a qualified financial advisor

The goal isn't to eliminate risk entirely but to manage it intelligently while positioning yourself for long-term financial success. Start implementing these wealth protection strategies today, and give yourself the confidence to navigate whatever market conditions lie ahead.

- Read more on: www.adroitfinancial.com