Revenue vs. Profit – What’s the Difference and Why It Matters for Investors

- Details

Why This Topic Matters (Especially for Investors)

If you've ever watched business news or browsed through a company’s financial report, you’ve probably heard the words “revenue” and “profit.”

But here's the thing: high revenue doesn’t always mean high profit. And as an investor, confusing the two can lead to bad stock decisions.

Many beginner investors are drawn to flashy sales numbers. But experienced investors dig deeper to understand whether that revenue is sustainable, and whether the profit is real or masked by accounting tricks or one-time gains.

In this blog, we’ll not only explain the difference between revenue and profit, but also how these numbers can mislead you if you don’t know what to watch out for.

What is Revenue?

Revenue (also called sales or top line) is the total money a business earns from its operations, like selling products or services, before subtracting any costs.

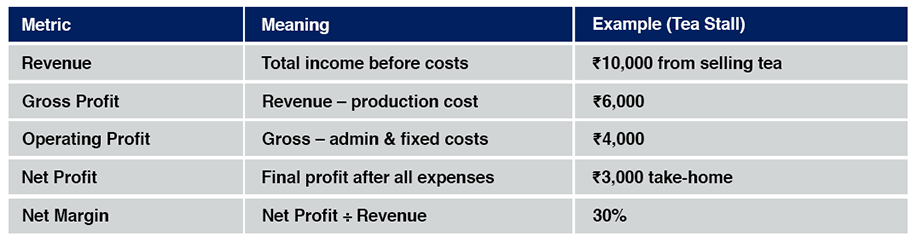

Example (Tea Stall Analogy):

Suppose you own a tea stall and sell 1,000 cups of tea at ₹10 each.

Revenue = 1,000 x ₹10 = ₹10,000

This is your total income, regardless of what you spent on milk, sugar, gas, or rent.

Important Investor Insight:

While high revenue can indicate market demand, it doesn't tell you if the business is making money. You need to look further.

What is Profit?

Profit (also called net income or bottom line) is what’s left after subtracting all costs and expenses, like raw materials, salaries, rent, taxes, and loan interest.

Continuing the Tea Stall Example:

- Revenue = ₹10,000

- Expenses = ₹7,000 (milk, sugar, gas, rent)

- Profit = ₹10,000 – ₹7,000 = ₹3,000

Now that ₹3,000 is your actual earning.

But what if gas prices suddenly rise and expenses go to ₹11,000?

Now you have a loss of ₹1,000, despite having high revenue.

Types of Profit: More Than Just “Net”

1. Gross Profit = Revenue – Cost of Goods Sold (COGS)

Tells you how efficient the company is in producing or sourcing its product.

2. Operating Profit (EBIT) = Gross Profit – Operating Expenses

Shows profit from core business before interest and taxes.

3. Net Profit = Operating Profit – All Other Expenses (interest, taxes, one-time costs)

The most complete view of profit, but also the most prone to manipulation.

Red Flags Investors Must Watch

Understanding revenue and profit is not enough. You must analyze what’s behind those numbers:

Red Flags in Revenue

- Revenue Growth without Profit Growth: This may signal rising costs or unsustainable pricing.

- Sudden Revenue Spikes: Check if it's from core operations or one-time sales (e.g., asset sales).

Red Flags in Profit

- One-Time Gains: Companies may sell land or investments to boost net profit temporarily.

Always check the "Other Income" - Accounting Adjustments: Non-cash items like deferred taxes or goodwill write-offs can distort real earnings.

- Understated Expenses: Low R&D or advertising might increase short-term profit but hurt long-term sustainability.

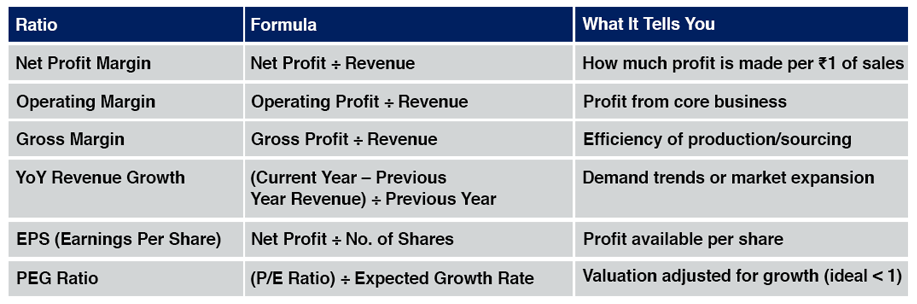

Key Ratios Every Investor Should Use

Here are some ratios that help you understand the relationship between revenue, profit, and business quality:

Pro Tip: Compare margins and ratios year-over-year and against competitors in the same industry.

Real-Life Example: How Revenue-Profit Gap Misleads

Let’s say Company A has ₹5,000 crore in revenue and ₹500 crore in profit.

Company B has ₹3,000 crore in revenue and ₹600 crore profit.

If you just look at revenue, Company A looks better.

But Company B has a higher profit margin (20%) compared to A's 10%.

So if you’re investing for profitability and returns, Company B is stronger.

Final Thoughts – Revenue Shows Sales, Profit Shows Strength

To wrap it up:

- Revenue tells you how much money comes in.

- Profit tells you how much money stays after costs.

- Don’t be impressed by revenue alone.

- Always check margins, one-time items, and growth sustainability.

Investor Tip: Before you invest in any stock, always go through:

- Profit & Loss Statement

- Segment-wise performance

- Notes to accounts (for one-time adjustments)

- Management commentary on earnings calls

Recap Table

Conclusion

Understanding the difference between revenue and profit isn’t just basic finance, it’s a powerful tool for better investing.

If you truly want to build wealth from stocks, start looking beyond the headlines and into the real numbers that reflect a company’s performance.

Read more on: www.adroitfinancial.com