How Fed’s Interest Rate Decisions Impact Indian Stock Markets in 2025

- Details

Why Should You Care?

Have you noticed how Indian stocks rise or fall when the US Fed announces its policy?

It might seem distant, it's a decision made in Washington, but it directly impacts your portfolio in India!

The Fed’s decisions affect foreign fund flows, the Rupee’s strength, and even sectors like banks, IT, and real estate.

So, understanding this connection is key for making smarter choices in your portfolio.

What Does Fed Rate Mean?

The Fed’s policy rate (called Federal Funds Rate) is the benchmark for borrowing in the USA.

When the Fed cuts it, borrowing becomes cheaper, companies grow faster, and investors move into riskier assets, including stocks in India.

When the Fed hikes it, borrowing tightens and many investors withdraw from riskier markets, causing selling pressure in stocks.

Fed's Decisions in 2025 So Far…

March 20, 2025: Fed kept its policy rate steady at 4.25–4.50%.

Nifty jumped +1.24% and Sensex rose +1.19%.

Bank and IT stocks led the rally.

December 18, 2024: Fed cut by 25 bps but struck a cautious note about future cuts.

Nifty fell about 1% and Sensex drops 1.2%.

Banks and IT were hardest hit.

June 18, 2025: Fed kept its policy rate steady at 4.25–4.50%.2025, policy.

Nifty fell by 0.08% and Sensex dropped by 0.10%.

Banks and IT were hardest hit.

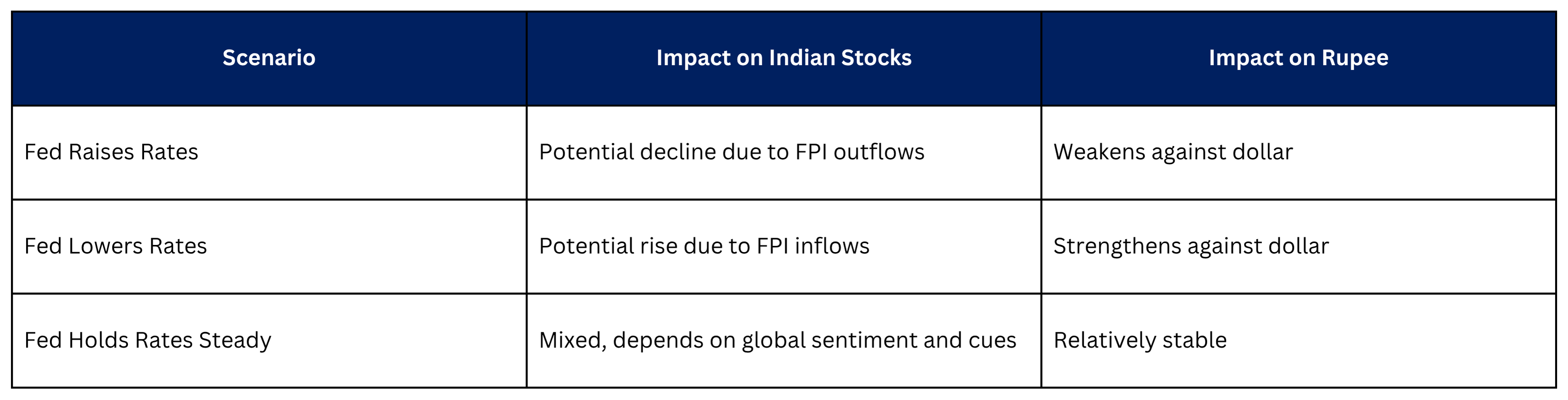

For India, the mechanism is straightforward:

- High U.S. Rates: Foreign portfolio investors (FPIs) may sell Indian stocks to invest in U.S. assets offering higher returns, weakening the rupee and pressuring Sensex and Nifty.

- Low U.S. Rates: A weaker dollar makes Indian stocks more attractive, encouraging FPI inflows and boosting market indices.

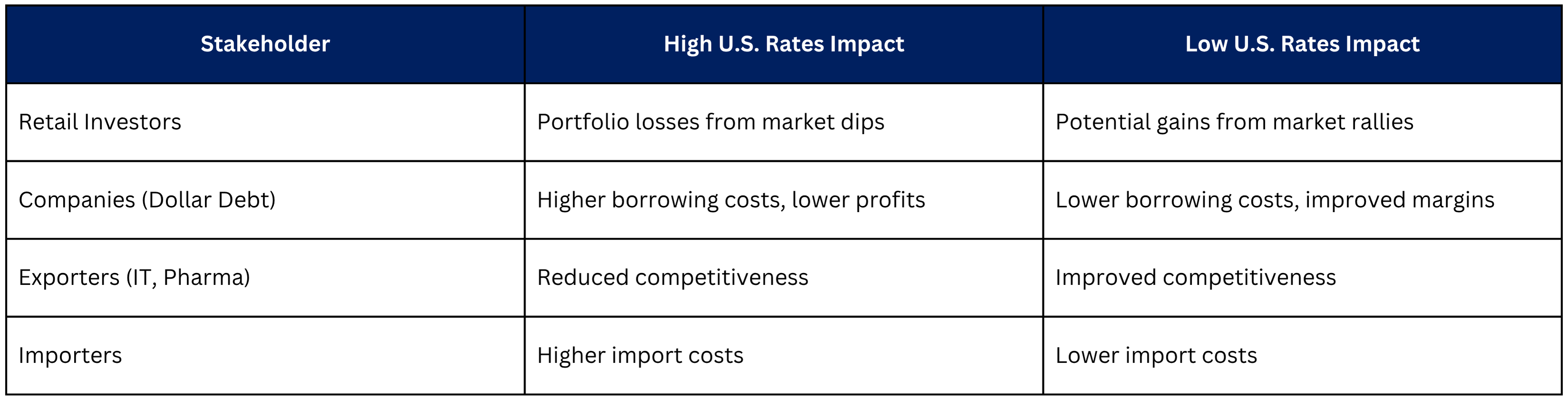

Impacts on Stakeholders

The Fed’s decisions create varied effects across India’s economic landscape:

- Retail Investors: High U.S. rates can lead to FPI outflows, lowering stock prices and impacting portfolio values of Retail Investors. Lower rates may boost market sentiment, offering gains for Retail Investors.

- Institutional Investors: FPIs adjust strategies based on U.S. yield differentials. High rates prompt outflows, while cuts encourage inflows, as seen in March 2025.

- Companies with Dollar Debt: Firms borrowing in dollars face higher repayment costs when rates rise and the rupee weakens, squeezing margins.

- Export-Oriented Sectors: IT and pharma, reliant on U.S. markets, may see reduced competitiveness if a stronger dollar raises costs for U.S. clients.

- Import-Dependent Businesses: A weaker rupee increases costs for industries like oil or electronics, potentially raising consumer prices.

- RBI and Policymakers: The Reserve Bank of India (RBI) may adjust rates to stabilize the rupee, impacting domestic borrowing costs.

Actionable Advice for Investors

To navigate Fed-driven market volatility, consider these practical steps:

- Diversify Your Portfolio: Spread investments across sectors like FMCG, healthcare, and utilities, which are less sensitive to global rate changes, unlike IT or banking

- Stay Informed on Fed Moves: Monitor Fed announcements via federalreserve.gov or trusted news like The Economic Times. Economic calendars list FOMC meetings, on 29-30 July, 2025.

- Leverage India’s Economic Strength: Focus on companies with strong domestic demand, as India’s projected GDP growth remains robust.

- Hedge Currency Exposure: If invested in dollar assets or export-driven firms, consult financial advisors for currency hedging to mitigate rupee volatility.

- Capitalize on Market Dips: Volatility, like the June 13, 2025, dip, can be a buying opportunity for long-term investors. Avoid panic-selling during short-term corrections.

Looking Ahead

The Fed’s interest rate decisions will continue to influence Indian markets in 2025, but India’s economic fundamentals, strong GDP growth, corporate earnings revival, and investor-friendly policies provide a solid foundation. While short-term volatility is likely, especially around Fed meetings, long-term investors can benefit by staying strategic and informed.

Summary: Final Takeaway

The Fed’s interest rate decisions are like global financial tides, when they shift, Indian markets feel the waves.

In 2025, with rates steady at 4.25%-4.5% and potential cuts on the horizon, investors face both challenges and opportunities. By diversifying, staying updated, and focusing on India’s strengths, you can navigate these changes with confidence. Keep an eye on the Fed’s next moves and position yourself for success in a dynamic market.

Read more on: www.adroitfinancial.com