Gold Prices React to Middle East Tensions: What It Means for Indian Investors

- Details

Have you noticed how gold prices have been jumping up and down lately? One day they’re sky-high, the next day they dip a little. What’s causing this rollercoaster? A big reason is the rising tensions in the Middle East, especially between Israel and Iran. These events are shaking up financial markets worldwide, and gold is feeling the heat.

Why Does Gold Matter When the World Gets Tense?

Gold is often called a safe-haven asset. But what does that mean? Imagine a stormy day when you’d rather stay safe indoors than risk going out. During times of conflict or uncertainty, like wars or economic troubles, investors feel the same way. They turn to gold because it’s seen as a stable, reliable option compared to stocks or currencies that can crash. When more people want to buy gold, its price goes up.

Right now, the Middle East is a hotspot of worry. Tensions between Israel and Iran have spiked with reports of military actions. Since the Middle East produces a lot of the world’s oil, any trouble there makes investors nervous about possible disruptions. So, they rush to buy gold, pushing its price higher.

What’s Happening to Gold Prices in India?

In India, gold prices have been on a wild ride because of this global unrest. For example, on June 16, 2025, the price of 24-carat gold shot past ₹1,01,000 per 10 grams due to the Israel-Iran conflict. But just a day later, on June 17, it is around ₹ 1,00,370 per 10 grams. This volatility pattern shows how sensitive gold is to what’s happening halfway across the world.

There’s another twist for India: oil prices and the rupee. India imports most of its oil, and Middle East conflicts can make oil more expensive. When oil prices rise, India spends more dollars, which can weaken the rupee. A weaker rupee means you need more rupees to buy gold (since gold is priced in US dollars globally). So, even if the world price of gold doesn’t change, it can still get costlier for us in India.

What Does This Mean for You as an Indian Investor?

This situation is a mixed bag, it’s both an opportunity and a challenge:

- If you already own gold: Congratulations! Rising prices mean your gold is worth more now. You could sell it for a profit if the timing’s right.

- If you want to buy gold: Be careful. Prices are high, and the weak rupee might make it even pricier. Plus, gold can be unpredictable, prices could drop if the Middle East tensions cool off.

Here’s a key point: don’t chase gold just because it’s trending. If the conflict eases quickly, the gold price rally might fizzle out, leaving late buyers with losses.

Smart Moves for Indian Investors

So, what should you do? Here are some practical tips:

- Don’t Go All-In on Gold: Think of gold as one part of your investment mix. Spread your money across different options, like stocks or fixed deposits, to lower your risk.

- Explore Alternatives: Instead of buying physical gold (like jewelry or coins), consider gold ETFs (exchange-traded funds) or sovereign gold bonds. These give you exposure to gold prices without the hassle of storing it.

- Watch the Bigger Picture: Gold isn’t just about India. Global events, like the US Federal Reserve tweaking interest rates, can also move prices. Lower interest rates often make gold more appealing, so keep an eye on international news.

Interestingly, some Indian investors are shifting away from traditional gold. More people are putting money into stocks or other market-linked options, possibly because gold’s so expensive right now or because other investments look promising.

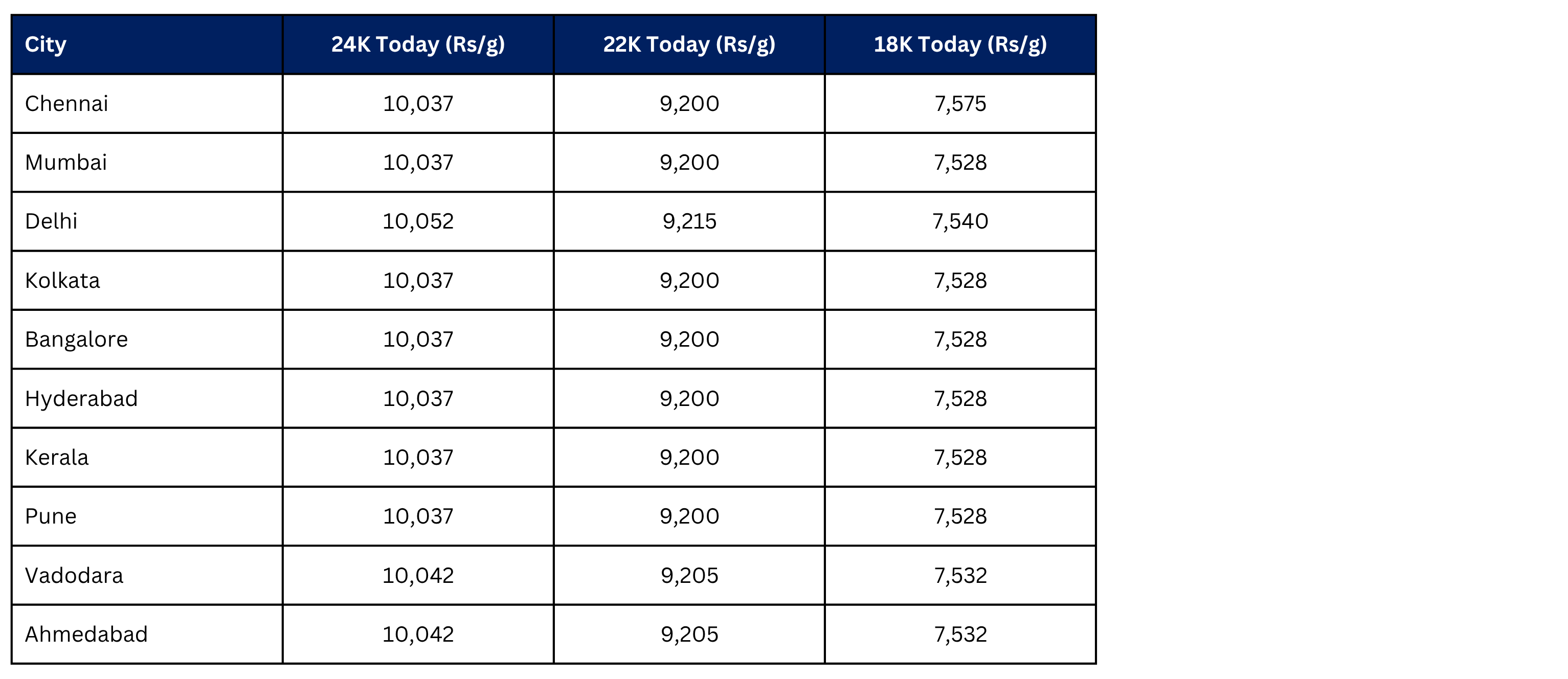

To illustrate the price variations across major Indian cities, here is a table based on the latest data as of 17th June, 2025:

Note: Prices are indicative and do not include GST, TCS, and other levies.

Conclusion:

The tensions in the Middle East are shaking up gold prices, and Indian investors are feeling the impact. Gold can be a safe spot to hide during stormy times, but it’s not a magic bullet. Prices can swing wildly, and the weak rupee adds another layer of cost. The smart move? Stay informed, diversify your investments, and think long-term. Whether you’re a gold lover or just curious, understanding these trends can help you make better money decisions.

Stay tuned to the news, not just from the Middle East, but globally.

Read more on: www.adroitfinancial.com