Bank Nifty Explained: What Every Trader & Investor Must Know

- Details

Decode one of the most traded and talked-about indices in Indian stock markets.

If you've ever tuned into business news or explored F&O trading, chances are you've heard of Bank Nifty. But what exactly is it? Why do traders obsess over it? And how can it help you become a smarter investor or trader?

Let’s break it down in the simplest possible way.

What Is Bank Nifty?

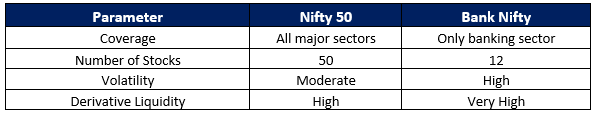

Bank Nifty (or the Nifty Bank Index) is a sectoral index that represents the 12 most liquid and fundamentally strong banking stocks listed on the NSE.

It includes both private and public sector banks, and is used to measure the performance of the Indian banking sector as a whole.

Much like how Sensex tracks the broader market, Bank Nifty tracks the banking sector specifically.

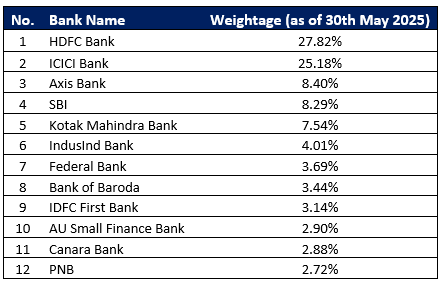

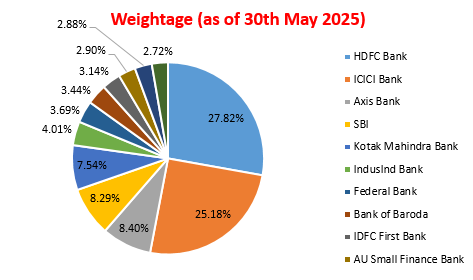

Current Composition of Bank Nifty (as of May 2025)

Updated Semi-Annually – This ensures only top-performing and high-liquidity banks stay in the index.

Why Is Bank Nifty So Important?

- High Trading Volume: Bank Nifty is one of the most actively traded indices in the Indian derivatives market.

- Economic Barometer: Banking sector performance often reflects the health of the economy.

- Used for F&O: Bank Nifty futures and options are favorites for intraday and positional traders.

- Volatility Brings Opportunity: More price movement = more chances for profit (and risk).

Note: This also makes Bank Nifty a double-edged sword, perfect for active traders, but risky for the unprepared.

How Is Bank Nifty Calculated?

Bank Nifty is calculated using the free-float market capitalization method, just like the Nifty 50.

This means:

- Only the market value of publicly available shares is considered.

- Heavier weightage is given to larger and more liquid banks like HDFC Bank or ICICI Bank.

Bank Nifty in 2025 – Key Trends

According to both NSE data, here’s what’s driving Bank Nifty this year:

- Improved PSU bank performance: Driven by NPA clean-up and capital infusion.

- Private banks consolidating: Focus on retail lending and digital transformation.

- RBI policy: Easing interest rates is fueling positive sentiment in rate-sensitive stocks like banks.

- Rise of retail trading: Bank Nifty options are a hotspot for daily and weekly traders.

Trading vs Investing in Bank Nifty

If You’re an Investor:

- Invest in Banking ETFs or banking mutual funds.

- Look for long-term plays in top private and PSU banks.

If You’re a Trader:

- Use Bank Nifty futures & options for intraday, swing, or expiry-day strategies.

- Watch for triggers: RBI policy, earnings, macroeconomic data, etc.

Risk Tip: Bank Nifty is extremely volatile, use stop losses, hedging, and proper position sizing.

Bank Nifty vs Nifty 50 – Quick View

How Can You Use Bank Nifty?

- As a trading instrument for short-term gains

- As an investment indicator to judge banking sector performance

- As a hedge against banking-heavy equity portfolios

- As a learning tool for understanding market cycles and rate sensitivity

Final Thoughts: Why Every Investor Should Watch Bank Nifty

Whether you're buying mutual funds or actively trading derivatives, Bank Nifty gives you deep insight into India’s financial health. It’s fast, it’s volatile, and it’s incredibly influential.

“When the banks lead, the market follows.”

So if you want to stay ahead in Indian markets, make sure Bank Nifty is on your radar.

Read more on: www.adroitfinancial.com