How the IPO market Shaped Up in 2024

- Details

India’s IPO market set a new benchmark in 2024, reaching a “historic milestone” as proceeds soared from $5.5 billion in 2023 to a staggering $11.2 billion—more than double the previous year’s total.

2024 witnessed India’s IPO market embark on a bullish spree, with proceeds rocketing to $11.2 billion—surpassing the $5.5 billion raised in 2023 by a wide margin. And the excitement doesn’t end here—the pipeline for 2025 is brimming with promise, fuelled by a wave of retail participation, strong domestic inflows, and Foreign Portfolio Investors (FPIs) making their mark, even as they remain net sellers in the secondary market.

This growth isn’t just a number; it’s a reflection of rising issuer confidence and an investor frenzy for those juicy listing-day pops and long-term growth stories.

The government’s strategic push on infrastructure development and a surge in private capital expenditure have been key drivers of the market’s dynamism, creating the perfect storm for IPO success.

India’s IPO boom isn’t just a statistical achievement—it’s a shining testament to the evolution and resilience of the nation’s financial ecosystem, solidifying India’s position as a global powerhouse for capital raising.

IPO Activity Snapshot:

- Hyundai Motor India Ltd: Hyundai Motor India, the subsidiary of South Korea's Hyundai Motor, made history by launching India's biggest-ever IPO, securing a massive ₹27,870 crores.

- Swiggy Ltd: Swiggy raised ₹11,327 crores. Representing the consumer technology sector, Swiggy’s listing highlighted the growing investor appetite for e-commerce and tech-driven businesses.

- NTPC Green: NTPC Green Energy Limited (NGEL), a subsidiary of NTPC Limited and a major public sector player in Indian renewables, raised ₹10,000 crores, delivering 12.6% listing gains.

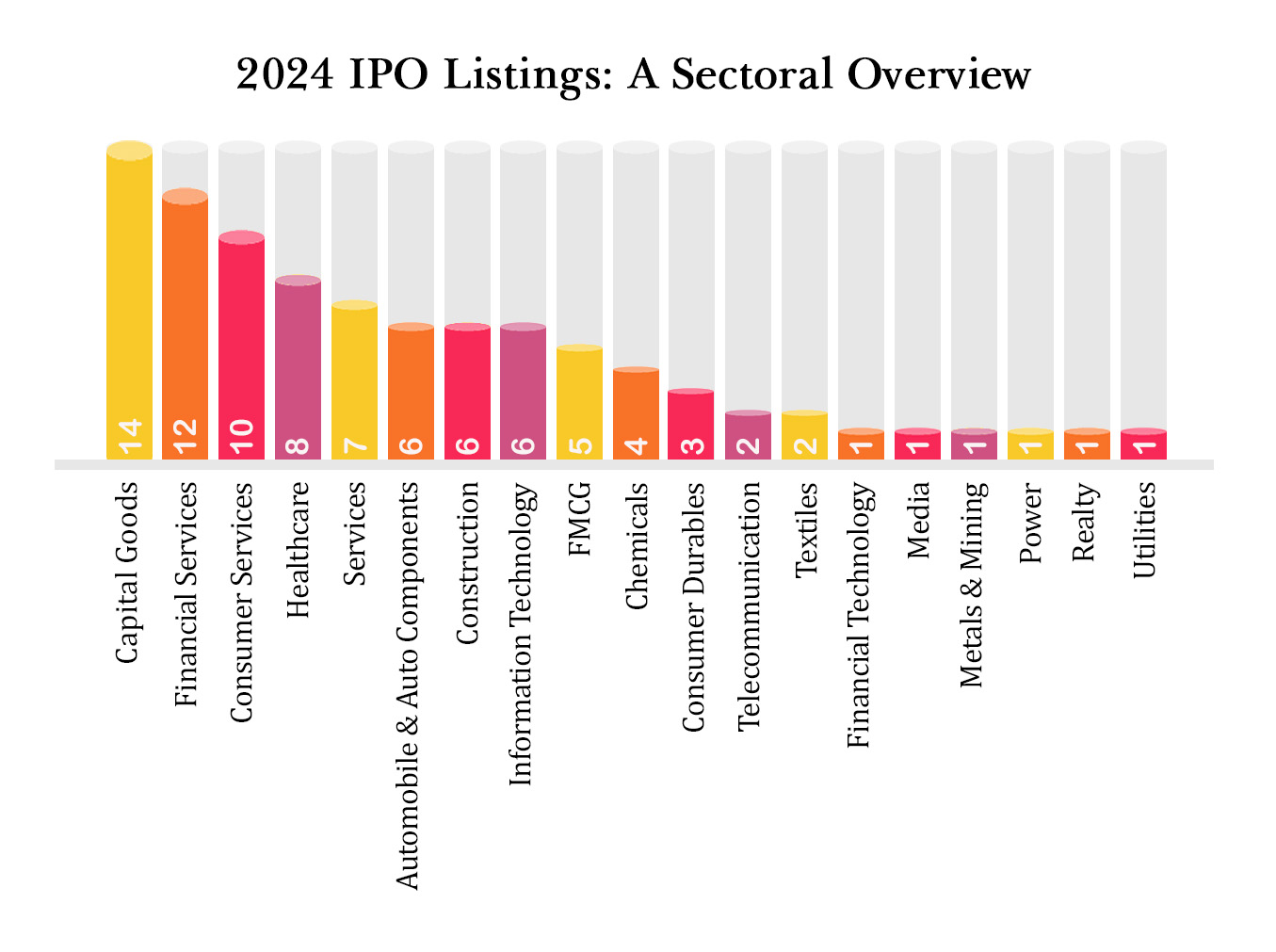

Top Performing Sectors:

- Capital Goods: The capital goods sector led IPO activity this year with 14 new offerings—the most of any sector. These IPOs collectively raised approximately ₹12,316 crores. Vibhor Steel Tubes Ltd. was a real standout, delivering incredible listing gains of 195.5%.

- Financial Services: The Financial services sector was the second most active in terms of IPOs, with 12 companies listing during the year. These offerings generated approximately ₹21,440 crores in total. Bajaj Housing Finance Ltd. delivered the strongest listing performance within this sector, with first-day returns of 135.7%.

- Consumer services: Consumer services ranked third in IPO activity, with 10 companies going public during the year. This sector collectively raised approximately ₹32,566 crores. LE Travenues Technology Ltd. led in terms of listing performance, achieving a 78.2% gain on its first day of trading.

Underperforming Sectors:

- Construction and Civil Engineering: Despite a robust pipeline of infrastructure projects, several companies, including Deepak Builders & Engineers India Ltd. ( -20.2%), Ceigall India (-3.5%), etc faced listing losses.

- Automobile: The automobile component sector demonstrated mixed performance, with a majority (3 of 6) of companies experiencing negative listing gains. Overall sector performance was weak, with losses ranging from -6.4% to -7.5%, indicating broad market challenges. Carraro India underperformed significantly, posting the largest losses at -7.5%.

Key Drivers Behind IPO Performance:

- Sector-Specific Tailwinds: Renewable energy IPOs are gaining significant momentum, and it’s easy to see why. Governments are rolling out strong incentives, while the global push for cleaner energy intensifies. This trend is sparking considerable excitement, with successful launches like NTPC Green Energy proving that investors are increasingly drawn to this sector.

- Investor Sentiment: Retail investors are showing greater sophistication, shifting their focus from short-term gains to long-term value. This evolving mind-set is reflected in the strong participation in recent IPOs, as India’s IPO market continues to expand impressively.

- Global Factors: Amid global economic uncertainty, India has emerged as the go-to investment hub. In 2024, the country overtook China to become Asia’s leading market for IPOs, drawing substantial foreign institutional investor interest.

Looking Ahead: A Stronger IPO Market in 2025 and 2026

The strength of the IPO market in the coming years will depend on macroeconomic and geopolitical factors. If the U.S. economy maintains its soft landing and geopolitical tensions remain stable, we expect the IPO market in 2025 to be more dynamic than in 2024, with higher deal volume and increased proceeds. This will set the stage for an even more expansive market in 2026.

We anticipate continued IPO activity from healthcare and foreign private issuers, along with a rise in private equity sponsor-backed deals, especially in the tech sector. Additionally, fintech issuers, including those in the digital asset space, are expected to see increased participation.

Missed out on the 2024 IPO rally? Don’t stress – 2025 promises even more opportunities! If you’re ready to ride the IPO wave, our platform is here to help. Whether you're a registered or non-registered client, visit our website to stay updated and explore the exciting IPO listings. For our registered clients, our mobile app offers a quick and hassle-free experience to apply through our E-IPO portal in just a few simple steps. Get ready to invest with ease and make the most of the upcoming IPOs!

How to Apply for an IPO via Adroit Website:

- Visit Adroit IPO Portal and enter your details. Existing clients can log in using their mobile number. New users must provide their PAN number and mobile number.

- After logging in, browse and select the IPO you wish to apply for.

- Review the IPO details and enter your UPI address. Once confirmed, a UPI mandate will be sent to you.

- Open your UPI app, approve the mandate, and complete your IPO application.

How to Apply for an IPO via Adroit Mobile App "TradeWhiz":

- Open the TradeWhiz app and log in as a registered user.

- From the main menu, select Apply IPO.

- Choose the IPO you want to apply for.

- Review the IPO details and enter your UPI address. Once confirmed, a UPI mandate will be sent to you.

- Open your UPI app, approve the mandate, and finalize the application process.

Quick, easy, and hassle-free IPO applications made possible with Adroit!

Read more on: www.adroitfinancial.com